Welcome to the Michigan Office of Retirement Services (ORS) website for members of the Michigan Public School Employees' Retirement System who began public school employment before July 1, 2010.

The retirement system provides competitive retirement and healthcare benefits and encourages you to take full advantage of them to plan for your future retirement. ORS manages the retirement system carefully to preserve it for you and other future retirees.

During your career, your employer takes care of your pension plan deductions, wage and service records, and any additional contributions. Your employer sends regular wage and service reports to ORS that become part of your personal pension record.

You also can enroll in the State of Michigan 401(k) and 457 Plans (the Plans) to help supplement your pension with additional retirement savings. ORS administers the Plans while Voya Financial takes care of the daily management. If you elected to participate in the Personal Healthcare Fund (PHF), it is also managed by Voya.

When it's time to retire, your employer sends your final records to ORS, and we become your partner in retirement.

| Pension Pay Dates | Message Board | Address Change |

If you first worked for a Michigan public school July 1, 2010, or later, you’re a member of either the Pension Plus Plan, Pension Plus 2 Plan, or the Defined Contribution Plan.

Public Act (PA) 158 will take effect on Feb. 13, 2024. The new law allows for a child to remain on retiree insurance until the end of the month in which that child turns 26, regardless of enrollment in post-secondary education or whether child is considered a dependent for tax purposes. For more information, please see Dependent Coverage.

If you wish to enroll a child who is now eligible as a result of this change, you may do so as soon as March 1, 2024 by completing and submitting an Insurance Enrollment/Change Request (R0452C) and all required proofs on or before February 29, 2024. When ORS receives your enrollment request and required proofs, coverage will be effective the first of the following month if your request is received prior to September 1, 2024. If ORS receives your enrollment request and required proofs on or after September 1, 2024, coverage will start the first of the sixth month after receipt.

Published on Feb. 2, 2024Public Act (PA) 250 of 2023 was signed into law Nov. 30. The new law changes the default retirement option for employees who first work at a Michigan public school on or after July 1, 2024. For more information about the changes, you can read our legislative summary or you can review PA 250 of 2023.

Published on Nov. 30, 2023

Public Act (PA) 147 of 2023 was signed into law Oct. 10, 2023. The law changes working after retirement rules for public school retirees through Oct. 10, 2028. Under the new law, public school retirees may return to work at a reporting unit after retirement with no impact on their pension or retiree healthcare benefits if they have a bona fide termination and they either earn less than $15,100 in a calendar year from their public school employment or they’ve been retired six consecutive months. It also changed the rules for retired superintendents who return to work at a reporting unit after retirement. For more information about the changes, see PA 147 of 2023 (previously House Bill 4752 of 2023) or ORS' legislative summary.

Published on Oct. 10, 2023

Updated on Oct. 18, 2023

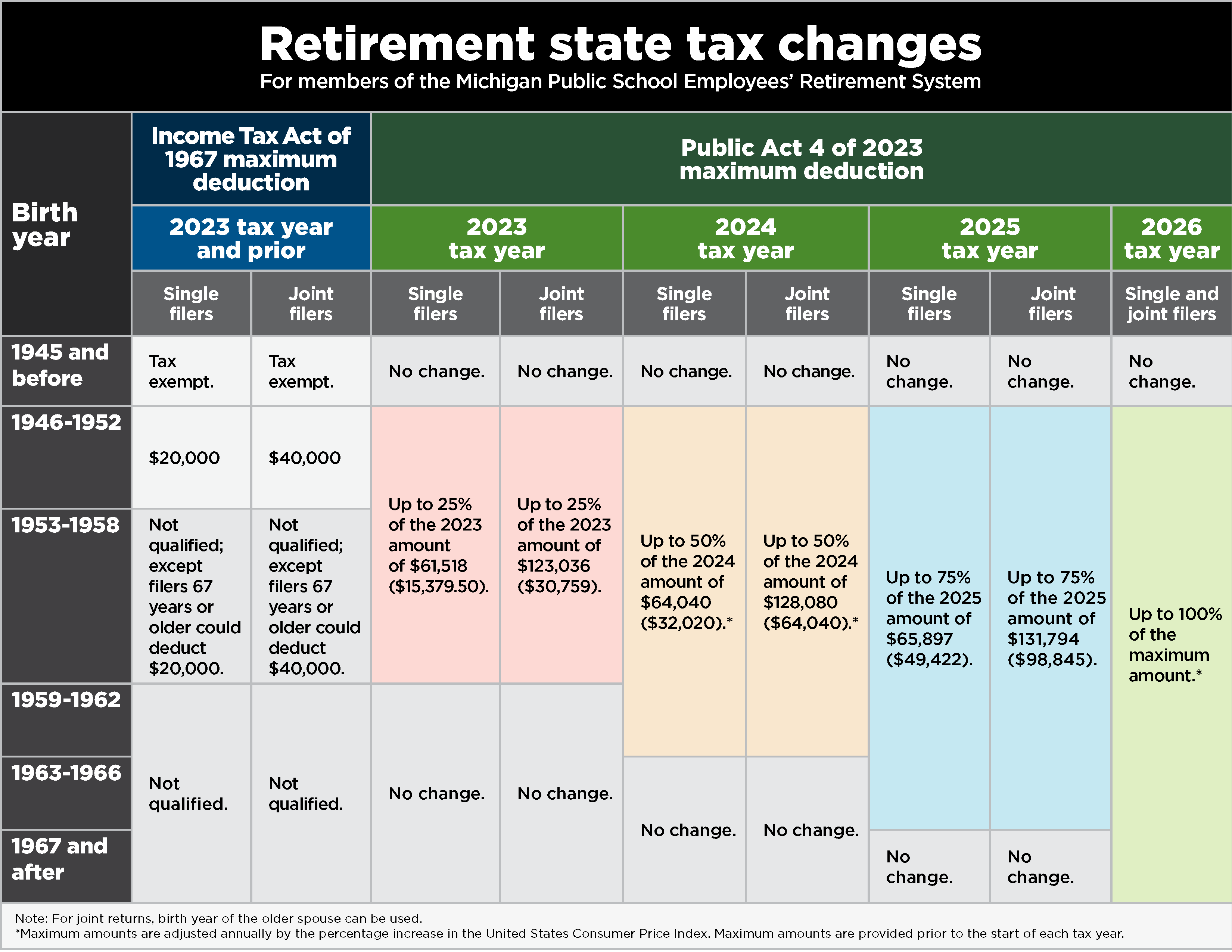

PA 4 of 2023 phases in an income tax reduction over the course of four years for retirees who receive a pension, beginning with the 2023 tax year (filed in 2024). Michigan’s 2023 tax return, forms, and instructions (e-file and paper format) incorporate all retirement and pension benefit subtraction options – including those created in the new law. Retirees who filed their taxes prior to the law’s effective date need not file an amended return. The Michigan Department of Treasury will work impacted returns as they are received and prepare them for release after the law’s effective date. For more details, see the Michigan Department of Treasury website.

For joint returns, the birth year of the older spouse can be used.

The Michigan Office of Retirement Services will continue to evaluate what the law means for our members as the phase-in continues. Please consult a tax professional regarding any questions you may have. To learn more about PA 4 of 2023, see the Michigan Legislature's page.

Published on March 7, 2023

Updated on Feb. 13, 2024